Benefits

A glimpse of the benefits of banking with us

ABOUT US

A Microfinance Bank with a Purpose

Omiye Microfinance Bank Limited started operation as a community bank incorporated and licensed to carry out community banking on September 12 1991.

- The Bank operated for several years successfully as a community bank until the banking reform of 2006 when the bank decided to transform unto a microfinance Bank.

- Omiye MFB was registered in Nigeria under the provisions of the Companies and Allied Matters Act CAP C20 LFN 2004 with registration number RC 165215.

- Our Vision

30+Years

of Experience in the Finance Service

Loan calculator

Online EMI repayment calculator

HAPPY

CUSTOMERS

AWARDS

WON

YEARS OF EXPERIENCE

Other Popular Offerings

Change Your View,

Find Opportunities, Succeed

Micro Credit Scheme

Savings and loan products designed strictly for individuals and micro, small and medium enterprises.

Remita Payments/E-banking

Enjoy electronic payment platform that helps individuals and organizations to easily receive and make payments across all banks.

Target Deposit/ ESUSU

Esusu Savings/loans, one will be able to save small daily contributions that could turn out big which can be withdrawn or use to get a loan

Our Process

Open Bank Account

Step

Fill In The

Required Form

Supply your details as required

Step

Submit All Your Documents

Upload necessary KYC documents

Step

Get Your Desired Account

Your account is ready after records verification and validation

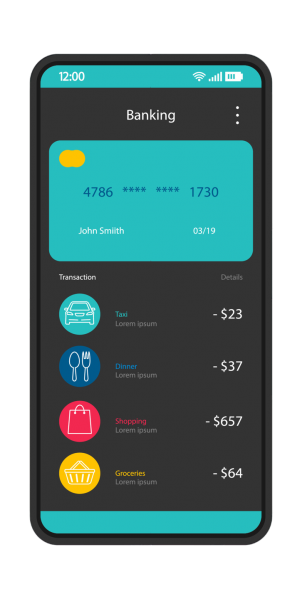

MOBILE BANKING

Get the Fastest and Most Secure Banking

What are you waiting for? start dialing... Dial *614*311# Fast, Secure & Reliable

OUR SERVICES

Explore more to

see more of our services

Digital Banking

- Internet Banking

- Mobile Banking

- ATM Card Service

- Remita Payment

- Quick Loan

- Debit Card Request

Meet Some of Our Partners

Award

Awards and Recognition

NULGE

Award of ExcellenceNigeria Union of Local Government Employee (NULGE) Oye Local Govt. Chapter

Interswitch

Customer Appreciation AwardRecognition of committed partnership over the years

NAMB

Best Microfinance BankBest Microfinance Bank consistent with returns 2018/2019

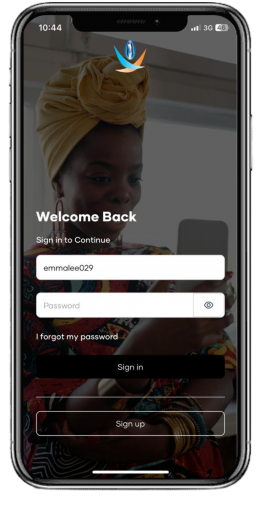

Mobile App

Get the Fastest and Most Secure Banking

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec felis, suscipit you take action against fraud. See it the Security Center for and Mobile and Online Banking.